Your Financial Action Plan

I wanted to talk about my new course on creating wealth. The aim is to build a practical financial education course. I was concerned that several of the existing financial self-help courses depend solely on chasing the lowest cost solutions. That is not…

SMSF Adviser: Budgeting in rising inflation necessary for SMSFs

This article by Keeli Cambourne was published in the SMSF Adviser on 30th March 2023. Rising inflation must be taken into account when trustees are establishing an SMSF, says a leading financial educator. Andrew Zbik, senior financial adviser with Creation Wealth, said budgeting…

Canstar: What Is The SIS Act?

Andrew Zbik wrote this article for Canstar on 28th September 2021 Australia has the fifth-largest pool of retirement savings in the world. These retirement savings are held within the superannuation system, which is largely governed by the Superannuation Industry (Supervision) Act (the SIS…

SelfManagedSuper: Shares can be turned into contributions

This article by Tia Thomas appeared in Self-Managed Super Magazine on 26th August 2021 SMSF investors wanting to make a contribution to their fund can use shares as an in-specie transfer, but have been advised to consider the impact on their tax and…

April 2021: Investment and Superannuation Update

Watch our investment and superannuation update for April 2021. GENERAL ADVICE WARNING: In preparing any advice in this video, Finans Pty Ltd trading at CreationWealth has not taken into account any particular persons objectives, financial situation or needs. You should, before acting on…

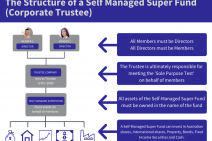

AdviserVoice: Costly self-managed super funds? Are they right for me?

It has been a heated month in self-managed super fund (SMSF) land. The Australian Securities and Investment Commission (ASIC) started the ball rolling with a fact sheet that stated SMSF Trustees spend on average 100 hours a year managing their SMSFs and that…

New superannuation measures stalled before 30th June 2020.

Yesterday, The Commonwealth Parliament concluded its June sitting days and will now not return until 4th August 2020. There were mixed results for the superannuation sector and financial advice with some bills becoming law (FASEA extension (Deferral of when Financial Advisers need to…

Smart Property Investment: Are self-managed superannuation funds causing a property bubble?

By Andrew Zbik – 30th January 2017 I recently watched another report on the TV claiming that the ability of self-managed superannuation funds to purchase residential investment property is causing a property bubble in Australia by using Limited Recourse Borrowing Arrangements (LRBAs) (or…

Morningstar: Are SMSFs causing a property bubble?

By Andrew Zbik If investing in property, SMSF trustees should have 10 years of working life left and should hold a cash buffer that amounts to six months of all property expenses. I recently watched another report on the TV claiming that the…