It has been a heated month in self-managed super fund (SMSF) land. The Australian Securities and Investment Commission (ASIC) started the ball rolling with a fact sheet that stated SMSF Trustees spend on average 100 hours a year managing their SMSFs and that the average cost of running a SMSF is $13,900 per annum.

The industry hit back citing research from the Australian Tax Office (ATO) 2017-18 SMSF Statistical Overview showing the median “operating expense” of SMSFs is $3,923. The SMSF Association claimed this was a more appropriate figure to focus on as opposed to an ‘average’ which is distorted by a small number of very large value SMSFs.

I am sure this causes more confusion for the average Australian. I am always asked by clients “Which super fund is best for me – industry, retail or an SMSF?”.

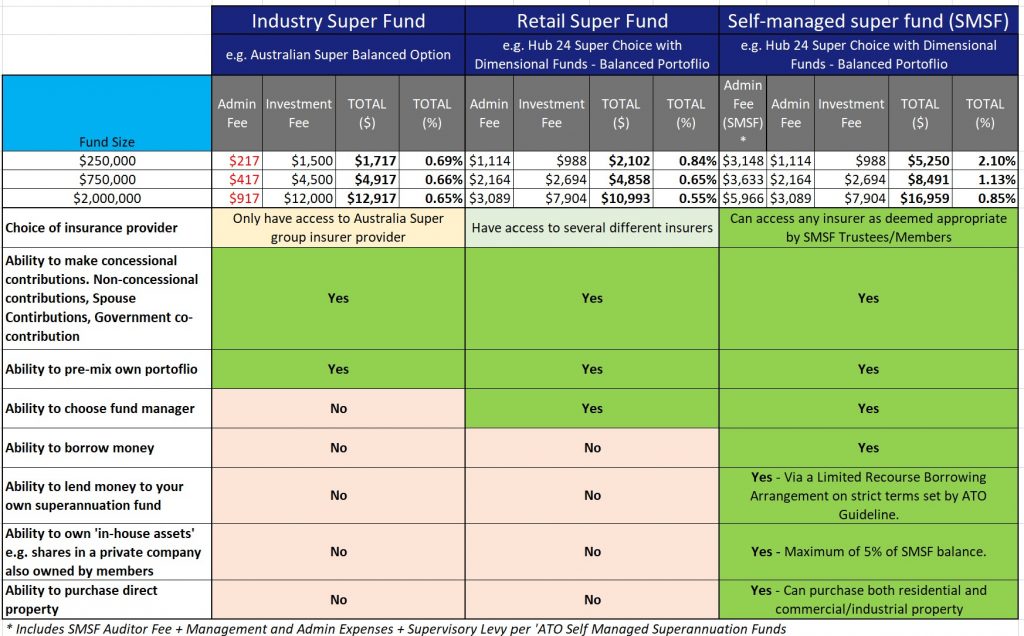

In the table below, I have prepared a basic comparison between industry, retail and SMSFs. However, you can see from below that fees are not the only consideration when determining which type of superannuation fund to manage your retirement savings.

I have compared a ‘Balanced’ portfolio which will typically have 60% of the assets allocated to shares and property securities and 40% to defensive assets such as cash and bonds/fixed income securities.

More than just comparing fees – how about insurance policies?

It is true that at first glance in my comparison, SMSFs may appear more expensive. However, there are other considerations such as what type of insurance policies can a superannuation fund own? Which insurance provider is appropriate? Industry funds offer a pooled style of insurance cover for members. Whereas, in some circumstances, an individual may not be able to obtain cover via group policy and require a more bespoke insurance policy that can be offered via a retail fund. SMSFs have the most flexibility in choosing which types of insurance policies can be held from the widest range of insurance providers.

Investment strategies can vary

From the table below, SMSFs can offer additional strategies that are not available with industry or retail funds. This includes the ability to borrow money, purchase direct residential property or commercial and industrial property. An SMSF can also own what is called an ‘in-house asset’. This is an asset that may be owned by the fund’s members such as shares in a private family business.

My calculations below do not factor in these strategies in the SMSF operating expenses. In some instances, the costs of property ownership included in an SMSF may result in the operating costs being cheaper than comparable industry or retail superannuation funds.

Everyone’s circumstances are unique. Different super balances, different stages of life, different aspirations mean any of the three options of industry, retail or SMSF may be suitable for an individual’s circumstances.

In summary, we need to stop debating if one type of superannuation fund if better than the other. We need to focus on which type of fund may be appropriate for an individual’s retirement strategy.

As a financial adviser, I can consider all three types of superannuation funds for my clients – industry funds, retails funds and SMSFs. If you are seeking advice from a financial adviser, make sure they do not have a history of recommending only one type of superannuation fund.

By Andrew Zbik, Senior Financial Planner

This article appeared in AdviserVoice on 3rd July 2020.