This article appeared in AdviserVoice on 6th October 2020. Written by Andrew Zbik.

Your child had their 8th birthday last week. Your mum-in-law again gave her yearly gift of $100 for your child’s saving account. Your second child is having their 10th birthday next month. In total, each child now has $4,000 to $6,000 in their respective savings accounts. You have been studiously putting away $25 per month for each child.

CUA found that 45% of parents who give pocket money for their children expect them to save it.[1]

Riaz Investments found in a survey last year that while 71% of parents say they do try and save toward their children’s future, only 27% of those surveyed had a regular savings plan for their children.[2]

If you have built a little stash of cash for your children, what are some options to grow that stash of cash?

1. Cash account

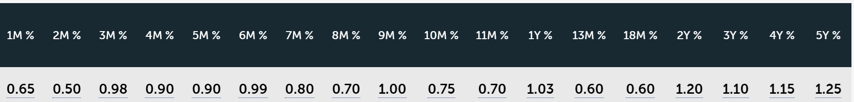

Most people I speak with will have a little bank account set aside for their children. Most banks will have a dedicated account available for children’s savings. However, with interest rates so low (as shown below), the return on cash is not that crash hot.

Source: Australian Money Market (Available cash rates as of 24th Sept 2020)

Despite the return on cash being quite low, I have generally found that if you have under $5,000 it is easier and cost effective to use a savings account to manage such a relatively small stash of cash.

2. Cash in an offset account

If you have a home loan with an offset account, you could place your children’s cash in the offset account. This will effectively save you the rate of interest you are paying on your non-deductible home loan. However, it may be hard to track what portion of cash is designated for your children. Secondly, even though it is helping you to offset interest on your home loan, it is hard to track those savings to your children’s stash of cash.

3. Diversified Manage Fund

I often get asked: “I have a savings account for my child. The cash has built up now. What shares should I buy?”

The problem with buying individual shares is that is a lot of risk exposure to a small handful of companies. Let along the brokerage costs of around $20 on a parcel of $1,000 shares equal a 2% transaction cost – that is steep. In the past I have recommended clients who have more than $5,000 to consider a diversified index fund such as the Vanguard LifeStrategy® Balanced Fund. This can be started with an initial balance of $5,000. The first $50,000 has a management fee of 0.90%. You can make a monthly BPAY contribution of a minimum $100. Their purchase costs equal 0.10% which is a lot cheaper than trying to buy parcels of share directly.

Importantly, it is a well-diversified portfolio that covers Australian shares, international shares, property securities, fixed income and cash.

4. Investment Bond

There is the option to consider an investment bond (also known as insurance bonds). These are a pool of investments where the manage pays the tax on your behalf. If you hold the investment/insurance bond for more than 10 years, you will not pay an additional income tax or capital gains tax.

However, if you have an event or the need to liquidate your investment/insurance bond within the 10 years period, the tax effectiveness may be lost.

Consider tax implications

Then there is the question of how should you structure the ownership of the investment for or on behalf of your children?

The ATO has a good summary of consideration to make when deciding how to own investments on behalf of your children:

Still ask before you act

It is always good to chat with an Accountant or Financial Adviser about what your intentions are in regard to investing on behalf of your children. Depending on the amount of money you have to start investing with and the amount of contributions you can put aside will influence which of the above options are appropriate for your goals and objectives.

By Andrew Zbik, Senior Financial Planner

———

SOURCES REFERRED TO:

1. https://www.cua.com.au/__data/assets/pdf_file/0021/235146/CUA_Infographic.pdf

2. https://raizinvest.com.au/blog/money-management-mishaps-children/