A Quiet Night for SMSFs

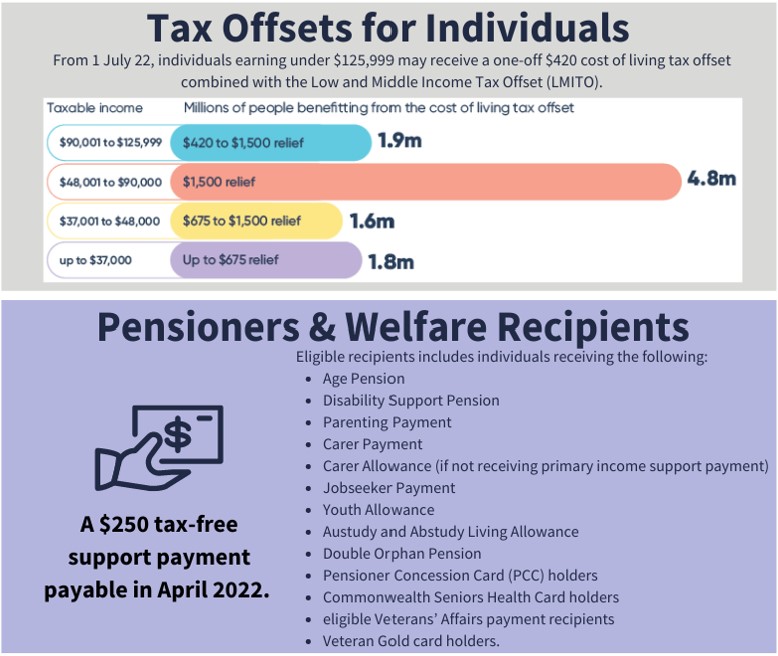

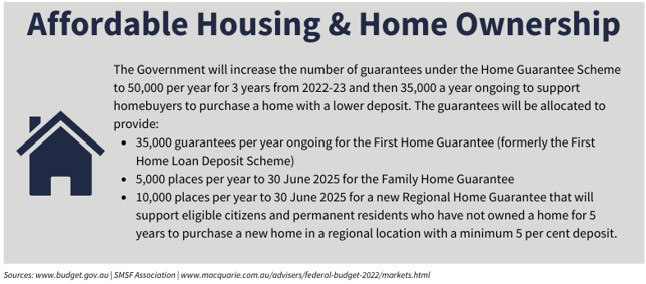

This year’s Federal Budget cost-of-living relief, job growth and women’s security. The key measures that you should be aware of as an SMSF trustee are outlined below. Should you wish to discuss how these may impact your personal circumstances or retirement plans please contact me to arrange a time to chat.

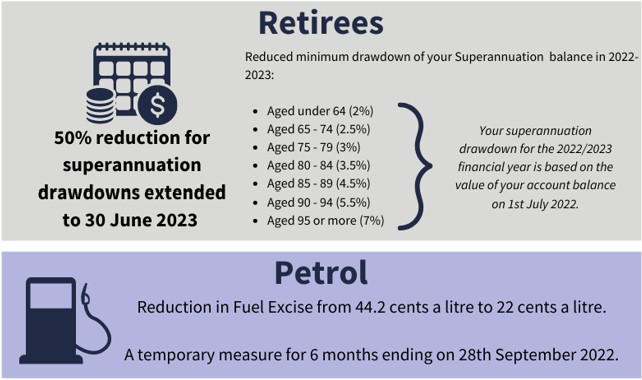

Extension of the temporary reduction in superannuation minimum draw down rates

The Government has extended the 50 per cent reduction of the superannuation minimum drawdown requirements for account-based pensions and similar products for a further year to 30 June 2023. The minimum drawdown requirements determine the minimum amount of a pension that a retiree has to draw from their superannuation in order to qualify for tax concessions.

Given ongoing volatility, this change will allow retirees to avoid selling assets in order to satisfy the minimum drawdown requirements.

Digitalising trust income reporting and processing

The Government will digitalise trust and beneficiary income reporting and processing, by allowing all trust tax return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes. The measure will commence from 1 July 2024, subject to advice from software providers about their capacity to deliver.

Trust income reporting and assessment calculation processes have not been automated to the same extent as individual or company tax returns, resulting in longer processing times and limited pre-filling opportunities. This measure will reduce the compliance burdens on SMSF trustees (taxpayers), reduce processing times and enhance ATO processes. The Government will consult with affected stakeholders, tax practitioners and digital service providers to finalise the policy scope, design and specifications.