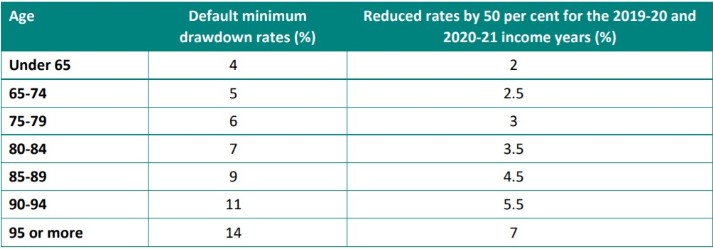

Tip 1: Get up to $500 from the Government Co-Contribution if an individual earns under $53,564 (May benefit someone in your household).

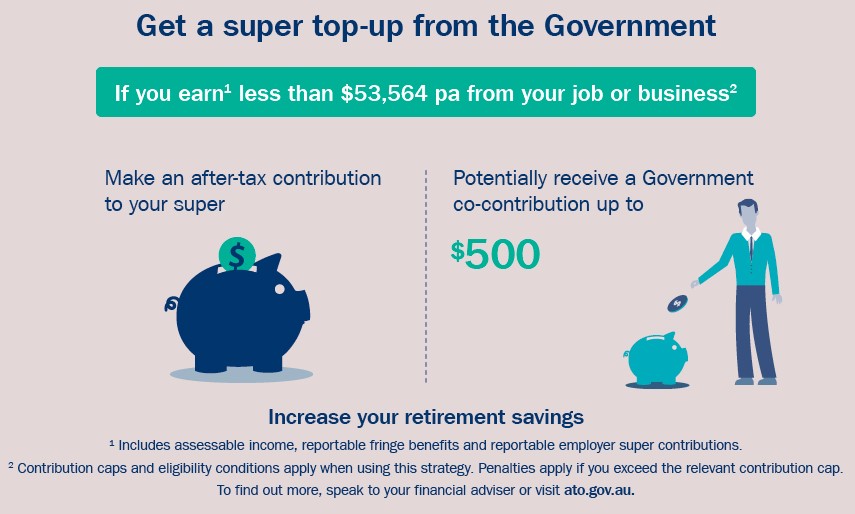

Tip 2: Get up to a $540 tax-offset if you make a $3,000 superannuation contribution for your spouse.

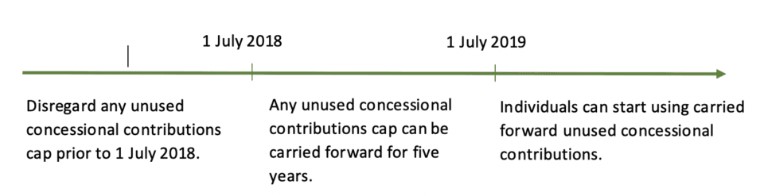

Tip 3: You can start to make ‘catch-up’ superannuation contributions for previous financial years if you did not maximise your $25,000 concessional contribution cap (e.g. employer and salary sacrifice contributions) to your superannuation.

Tip 4: If your income has increased or decreased by more than 10% this financial year – call me.

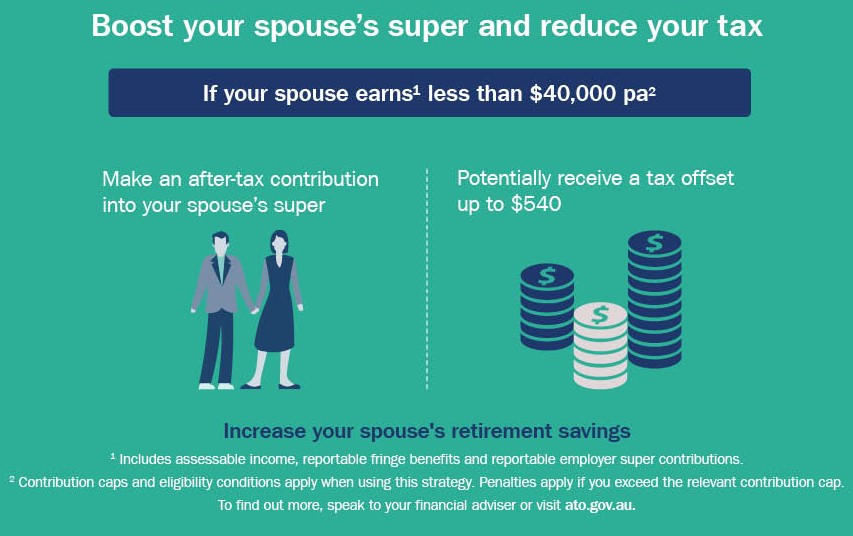

Tip 5: If you are drawing a pension from your superannuation fund and don’t need all the cash – the minimum pension withdrawal requirements have been halved for this and the next financial year.