By Andre Zbik. Published on AdviserVoice on 23rd February 2021

In July 2013, Australians’ superannuation savings started getting an extra boost when the superannuation guarantee contribution (the contribution that is mandated for employers to pay on top of workers’ salaries) increased above 9% for the first time in more than a decade. The plan to increase these contributions to 12% of a worker’s salary stalled in 2015 after a change in Federal Governments. Seven years later, the ‘postponed’ increases are due to start after 1st July 2021. The current schedule of increase will have all Australian workers contributing 12% of their income to superannuation by 2026.

Once again, there is political pressure to halt this increase.

I think this decision would be a tragedy for the long-term wealth creation of individual Australians and Australia as a nation.

Below are my six reasons why the superannuation guarantee increase needs to proceed.

1. Impacts of delaying further super increase

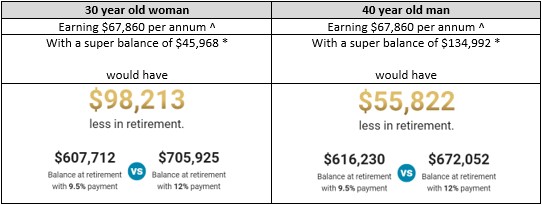

This is a topic that has been covered many times before. By delaying the increase in the superannuation guarantee from 9.5% to 12% Australians will have less super in retirement. Industry Super Australia have created a good calculator where you can calculate the impact of the any delay in the superannuation guarantee to your retirement savings.

For example, the below shows the impact on superannuation savings if the superannuation guarantee were to be delayed:

2. What about helping young Australians buy a first home instead?

This is an argument been pushed by Federal MPs such as Tim Wilson in his online petition. He thinks Australians should be using their savings first to buy a home and second to save for retirement. This seems like a plausible argument and a logical one.

However, I argue that compulsory superannuation is NOT the reason why home affordability is such a challenge for young Australians. Policies over the last two decades have seen the cost of young Australians obtaining university or vocational qualifications increase. Many now are paying off a HECS/Fee Help loan for almost a decade after entering the work force. We still have a tax system that significantly favours property investors through negative gearing. Finally, whilst the value of any home is exempt from the Commonwealth aged pension assets test, there is no incentive for retirees to downsize from a home that may be more suitable for a younger family with children. These are the issues that are making housing affordability a challenge. Allowing young Australians to reduce their superannuation contributions will not address these problems.

3. Secret tax by not paying additional superannuation guarantee

When an employer makes superannuation guarantee contributions on behalf of a worker, these are taxed at 15%. If this same amount of money is paid directly as income, it is taxed at your marginal tax rate which can vary between 19% to 45% plus the 2% Medicare Levy.

By diverting potential superannuation guarantee contributions to workers directly, the Federal Government collects more income via personal income tax. That means less after-tax dollars for Australians.

4. Is your super on top of your base or part of your salary package?

There is an argument that increasing your superannuation guarantee contribution will mean you take home less pay. This is partially true but not entirely accurate for all Australians.

Traditionally, the superannuation guarantee was paid in addition to your base salary. For example, if your employment contract is $60,000 + super, your employer will pay a gross income of $60,000 to you (less personal income tax withheld) and then make an additional $5,700 superannuation guarantee (or 9.5% of your base salary) to your superannuation fund. Prior to the proposed increase in superannuation guarantee, this worker’s total income (salary plus super contribution) is $65,700.

Thus, when the superannuation guarantee increases to 10% as scheduled in July this year, your base income does not change but your employer will then be required to make an additional $300 contribution to your superannuation fund (a total of $6,000). The worker’s total income is now $66,000.

In this instance, the employer is out of pocket as a result of the increase in the superannuation guarantee. Given the low wage growth we have seen over the last decade, this is almost a quasi-mandated total income (wage + super) increase for many Australians.

The alternative is the ‘salary package’ arrangement which has been increasing with many employers over the last decade. This is where a worker will have a total salary package of $65,700. With a 9.5% superannuation guarantee ($6,241) the employee will be paid a gross income of $59,459. However, when the superannuation guarantee is increased to 10% (or $6,570) the employee will be paid a gross income of $59,130, a decrease in gross income of $329 but an increase in superannuation guarantee of $329. The total income of the worker does not change, but the ratio of take-home gross income compared to superannuation guarantee does.

5. Keep fees in perspective

An argument against increasing the superannuation guarantee is that superannuation funds and the superannuation industry (including myself as a financial adviser) have a vested interest in increasing superannuation guarantee contributions as they will earn more fees. Yes, it is true that as the amount of money in the superannuation system increases, more fees in dollar terms will be paid to the superannuation industry.

Canstar reports that on average Australians will pay between 0.89% to 1.29% of their superannuation balance in fees.

However, I think this argument is like cutting off your nose to spite your face. How logical is it to say “No, I don’t want my superannuation balance to increase because my superannuation fund earns 1.29% in fees. I am happy to forego the 98.71% left to go towards my retirement savings”.

Australia has the fourth largest pool of retirement savings in the world due to our compulsory superannuation savings system. Why would we stop allowing Australians to accrue more for their retirement because fees are paid on superannuation? Secondly, the good news is that fees on superannuation is trending downwards. Fees payable on superannuation should not be an argument against increasing the superannuation guarantee.

6. Unnecessary complications – this Government is doing anything but keeping super simple

An alternative the Government is reportedly considering is to mandate that everyone’s superannuation guarantee will increase to 10% on 1st July 2021. For future years, employees may then have the option to either take the ‘additional increase’ as a superannuation guarantee or take-home pay.

This does not make the super system simpler. Nor does it make it easier for employers. Imagine now having to manage different requests from difference employees – “Yes, pay my 10.5% superannuation guarantee all to my superannuation fund” or “No, pay only 10% superannuation guarantee to my superannuation fund and the additional 0.5% as salary to me”.

This is a potential nightmare for employers. Hence, if we are serious about keeping superannuation ‘simple’ we are best having one consistent rate of superannuation guarantee across all workers.

In summary, Australians can only benefit in the long-term by increasing the superannuation guarantee from 9.5% to 12%.