Looking at why investment markets are recovering during a recession and what strategies should be considered.

The below graphic is from Vanguard. It shows how expected future returns have adjusted following the COVID-19 global shutdown. Despite fear selling news and the world entering recession, the drop in asset prices essentially means investors can purchase the same assets for a lower price. This results in an increase in the long-term expected returns from assets over the next 10 years.

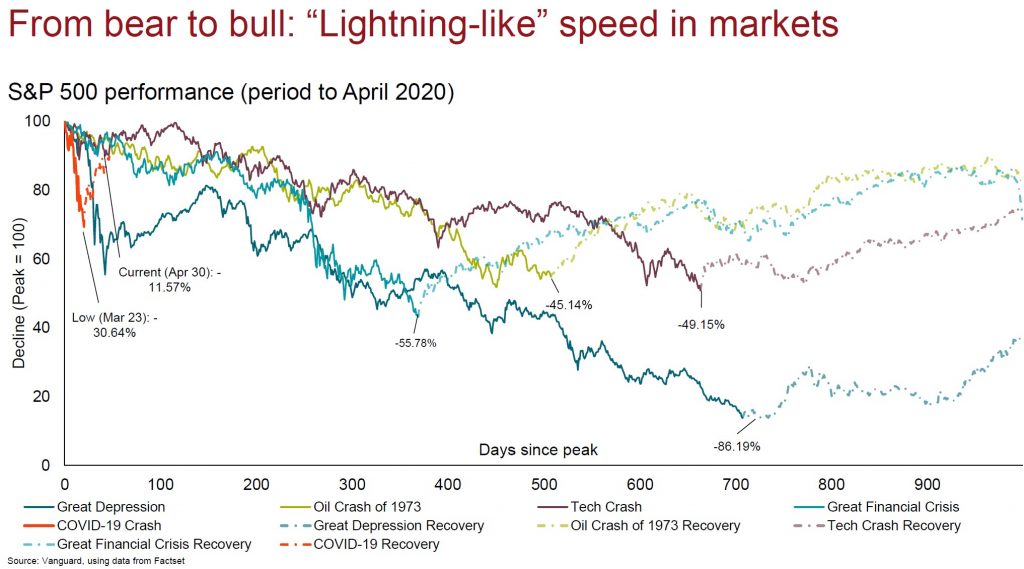

The below graph shows the speed of the COVID-19 correction on investment markets in comparison to other significant market corrections such as the Great Depression, 1973 Oil Crisis, Tech Wreck and the Global Financial Crisis.