Alternative investments can get a bad press. “We start out,” says James Purvis, “with the mindset that an alternative asset is usually an alternative to making any money.”

Purvis is part of the PHAROS Investment Committee that helps 46 affiliated advisory practices with their allocations, and you can see why he is cynical.

“The alternatives bucket tends to attract anything the marketing department thinks is new and bright and shiny,” he says. “But there are plenty of hedge funds that struggle to do better than cash.”

But PHAROS’s portfolios – whose default allocation to alternative is zero – currently have 10 per cent of their money in these strategies, spread across three underlying managers. And they work. They deliver and they diversify.

The conclusion: there are plenty of alternative investments that can cost you plenty for achieving very little. But if you’re picky, and understand clearly what you’re getting, then alternatives can work for you.

When mainstream asset prices plunge, alternative investments are increasingly being heralded as a safe port in a storm. Investors buffeted by volatile markets can expect more to come, say leading US hedge fund managers.

Ray Dalio, founder of the world’s largest hedge fund firm, Bridgewater Associates, suggests investors consider buying alternative assets that are diversified away from typical stock and bond markets. Tighter monetary policy, he says, will impact all traditional asset classes.

What is an alternative? The term is somewhat elastic, but generally includes hedge funds (which covers a broad church of strategies and approaches), private equity, infrastructure and commodities. (Some think it includes real estate too, though we leave that aside in this article.)

The theory of an allocation to alternatives is that it is uncorrelated with mainstream asset classes of shares and bonds. So when those two asset classes are underperforming, alternatives will keep your portfolio on track, delivering returns through the bad times. They can also be defensive, helping to preserve capital while also giving a new avenue for growth.

Despite a sometimes shaky public image, they’re not meant to be inherently risky. “People use words like play or punt, and I don’t think alternatives should be viewed in that way,” says Kris Walesby, head of ANZ ETFS Management. “Alternatives let you try something left of centre, but don’t necessarily mean increasing volatility to achieve outsize returns.”

Now is the sort of environment in which people tend to look afresh at alternatives: uncertainty in choppy equity markets given a largely grim global outlook, and bonds delivering next to nothing.

Promise of extra return

“With fixed income there is a good chance you’re going to get a net negative return, and in equities global growth is receding, so the outlook for the next three to five years is subdued,” says Mark Wills, head of the investment solutions group for Asia Pacific at State Street Global Advisors. “Where do you look for extra return?” Alternatives.

But do alternatives do what they’re meant to – offer diversification and a return that keeps delivering when other asset classes falter? Too many do not.

The research group PlanforLife, for example, breaks out an alternative investment category within its overall wholesale fund research. It shows that, in aggregate, returns from alternatives look very like returns from the overall industry.

In the year to March 2016, wholesale funds overall recorded a 3 per cent loss – and alternatives recorded a 3.6 per cent loss. In the year to March 2015, funds overall generated 12 per cent, and alternatives 12.3 per cent. The year to March 2014? Overall 12.1 per cent, alternatives 11.2 per cent. Not much diversification there.

But that’s an oversimplification, for several reasons. One is that alternatives cover such a wide range of styles and approaches that averaging their performance collectively is counter-intuitive.

A look at funds covered in Morningstar’s database, for example, shows that one-year returns to July 31 vary from a 39 per cent gain (Macquarie Alpha Opportunities) to a 24.4 per cent loss (Odey International Fund).

Another is that, by and large, mainstream asset classes have done OK in recent years – double-digit gains followed by a modest loss – and this is not the environment in which one is normally looking to alternatives to do something different.

This all points to being very selective.

“You’ve got to be very granular with the funds you look at,” says Craig Stanford, head of alternative investments at Morningstar. “We invest money in three different hedge funds that all invest in Australian equities, but they do it very differently: their correlation to each other is very low and their correlation to the index is very low. But I could show you hedge funds that invest in Aussie equities whose correlation to the Australian equity index is very high.”

So how to decide which do the job and which don’t?

Extra layer of fees

“The easy answer is… that it’s not easy,” says Stanford. “It takes a lot of experience and a lot of work to do it. It is very difficult for a mom and pop investor to do a good job investing in hedge funds.”

This is the biggest argument for using a fund-of-fund or multi-manager structure: it means somebody else has made the call on the right funds to invest in (but you’ve still got to trust them to get it right, of course), and your risk is spread across multiple funds.

If you invest in one of the PHAROS portfolios, for example, you’re getting the benefit of the fact that Purvis and his team have sifted through hundreds of products, disliking most of them – “we very rarely find any that are any good” – before happening upon a few he sees as standouts. Two are commodity-related funds, from Winton Capital Management and AQR, and the third is a global fund run by PineBridge Investments. (There is also a reserve bench of several other funds they are willing to invest in.)

There are, though, arguments against this too, chiefly the fact that it’s adding another layer of fees into a sector where fees are already notoriously high.

“The internal fees for these alternative assets are usually the highest out of any asset that a portfolio will contain,” says Andrew Zbik, senior financial planner at CreationWealth.

Morningstar gives this advice: “Fees can be a substantial drag on the returns the investor receives, and [this] is especially an issue in a low-return environment.” Ten years ago, the so-called two and 20 model – 2 per cent flat fee, plus a 20 per cent performance fee – was widespread, and though fees have come down a little, they are still higher than the norm in more mainstream asset classes.

Look at track record

A fund-of-fund product puts an extra fee on top of all those underlying fees, though managers of products like this argue that their slice is well earned. “Yes, the fees are one aspect of the cost, but a bigger cost would be investing in underperforming managers or losing 100 per cent of your money investing in a fund that turned out to be a fraud,” says Stanford.

High fees can be OK, if managers earn them.

Purvis reckons that the Winton fund he invests in can end up costing 3 per cent a year in fees once performance structures are factored in, “but we’re getting a lot more in returns.” What you don’t want to be doing is paying higher fees for something that doesn’t do what it’s meant to. “A good number of hedge funds struggle to do any better than cash.”

Wills adds: “There is a tendency to wrap relatively straightforward strategies and charge 2 and 20 for them.” In particular, he points to global macro funds, a common strategy that is basically just a tactical asset allocation tilt.

“We’ve got a listed ETF in the US of all our tactical allocation strategies. You can buy that, you don’t need to pay 2 and 20 for them.” In practice, most Australians buying a fund directly will be purchasing a long-short equity fund, where a fund manager can take positions that benefit from stocks going down in value as well as up.

If you do invest directly into a hedge fund or other alternative, there are a few things you can do to be confident. “They can provide a buffer against falling equity markets, but look at their track record during previous times to see how the strategy performs,” says Tim Wedd, executive director at Crystal Wealth Partners.

Complex asset class

Transparency is important. “If we can’t understand what they’re trying to do, we won’t buy it,” Purvis says. “There’s a correlation between managers being willing and able to do explain what they do, and their capacity to go ahead and do it. The ones that are uncommunicative either don’t fully understand what they’re doing or there’s a hole they don’t want to disclose.”

Still, Stanford reckons transparency has got better. “In 2000, disclosure from some funds was so bad you would literally get a fax with a performance number, and that was it.”

Hedge funds aren’t the whole story with alternatives. Private equity – investing in businesses before they’re listed – promises the opportunity to get into new businesses at the ground floor, though some advisors are bearish. “We think the returns are too strongly correlated with the returns in public markets,” says Purvis. “People like TPG have to offload their assets into the public markets to crystallise their returns.” Since he sees them as offering no diversification yet less liquidity, he doesn’t use them.

Wills at State Street takes a similar view. “There are some outstanding private equity managers, but it is a very complex asset class and very expensive.”

Then there’s infrastructure, which can be approached in a variety of ways.

Buying into physical infrastructure itself is strictly the preserve of superannuation and sovereign wealth funds, like the Future Fund, which has 6.7 per cent of its portfolio in infrastructure. “Infrastructure is a fantastic inflation hedge, but it is super expensive,” says Wills. “When you own a toll road, it is easy to put the price up. But the trouble is there is a finite number around the world and a seemingly endless number of sovereign wealth funds and pension funds wanting to buy them.”

There are more accessible investment products available: listed infrastructure companies such as Transurban Group or Sydney Airports Holdings (which some investors use as the best way to get their infrastructure exposure) or listed infrastructure funds, such as the Hastings Diversified Utilities Fund or Duet Group.

Clearly, though, these carry some stock market exposure and many investors consider them within their equity allocation. “The reason infrastructure is popular now is because rates are so low,” says Walesby. “Infrastructure is usually very stable and it gives above-central bank rate returns in most developed markets – stable and good yields.”

Another vital consideration around alternatives is liquidity.

One reason the asset class fell out of favour during the GFC was because several of these products locked up, and investors couldn’t get their money out when they needed it. “We try to understand what a fund invests in, how liquid is it in the good times and how illiquid in the bad,” says Stanford.

And if a fund promises great liquidity but invests in things like loans that can’t be sold quickly, ask yourself if it is as liquid as it says.

Purvis says all the funds he invests in have daily “or at worst monthly” liquidity, one reason he stays out of private equity. “It’s like unlisted property funds: everything looks terrific, until it doesn’t.”

Finally, be realistic about what alternatives will do for you. “The expectation is often that alternatives will give higher returns,” says Wedd. “It’s not necessarily the case, so don’t approach this sector with that intent. The real purpose is about generating better risk-adjusted returns – or, to put it another way, to achieve a better return for a unit of risk.”

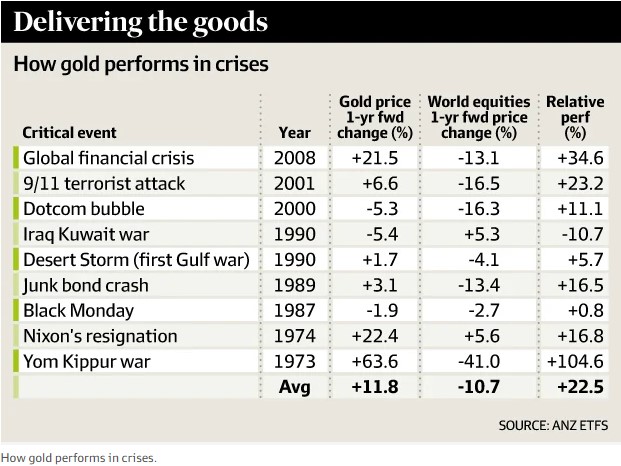

Gold, the great diversifier

It’s an article of faith that when all about you is falling, gold will rally. The ultimate safe-haven investment, gold is the place investors retreat to in the absence of certainty anywhere else. Even when times are stable, it is commonly used as an inflation hedge.

“We are particularly bullish on gold,” says Kris Walesby at ANZ ETFS. “Gold is a very strong way of protecting the real value of your portfolio. It diversifies a portfolio very well, brings down risk, and it is rallying.”

The only problem is that gold has already done plenty of rallying. It’s up about 25 per cent since January, although still well below the levels it hit in 2011.

“We have calculated that the gold price should be US$1420 to 1460,” compared to US$1311 today, “mainly because the inflation cycle will still kick up,” Walesby says. “There’s not a lot of upside from here, but there’s still another $100.” He recommends having as much as 5 per cent of your overall portfolio in gold at any one time.

It’s a common view, but not universal.

“Simply buying gold does not produce an income stream,” says Andrew Zbik at CreationWealth. “Yes, gold is traditionally seen as a hedge in times of poor economic conditions. However, the movement in the gold price is extremely volatile and very speculative.”

Beyond gold itself, there are strategies that invest in a range of commodities. But China’s outlook makes the commodity markets particularly difficult to read: the commodity boom has already ended in Australia, partly because of China’s slowdown.

There are dedicated commodity funds, such as the Winton Capital Management fund, or increasingly investors can gain exposure to commodities (and gold in particular) through exchange-traded funds (ETFs).

This article by Chris Wright originally appeared in The Financial Review on the 23rd September 2016. References to Andrew Zbik have been amended to mention CreationWealth